Published: January 2026

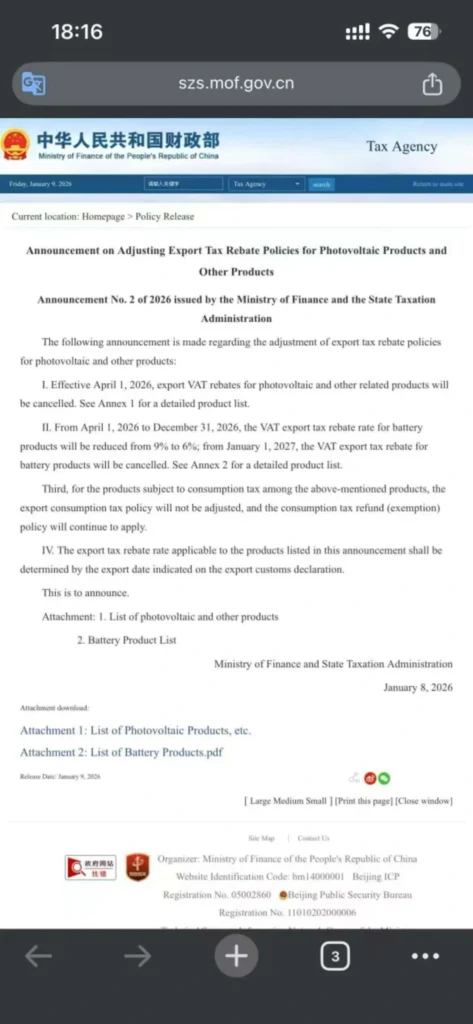

Recent reports from official media outlet China Daily confirm that the Chinese Ministry of Finance and the State Administration of Taxation have officially announced a phased adjustment and eventual cancellation of export tax rebates for battery products. This major policy shift means that export costs will be directly reflected in market prices, and global buyers must pay close attention to this transition.

As your strategic partner, ELFBULB has summarized the timeline of these changes and their impact on costs to help you plan ahead.

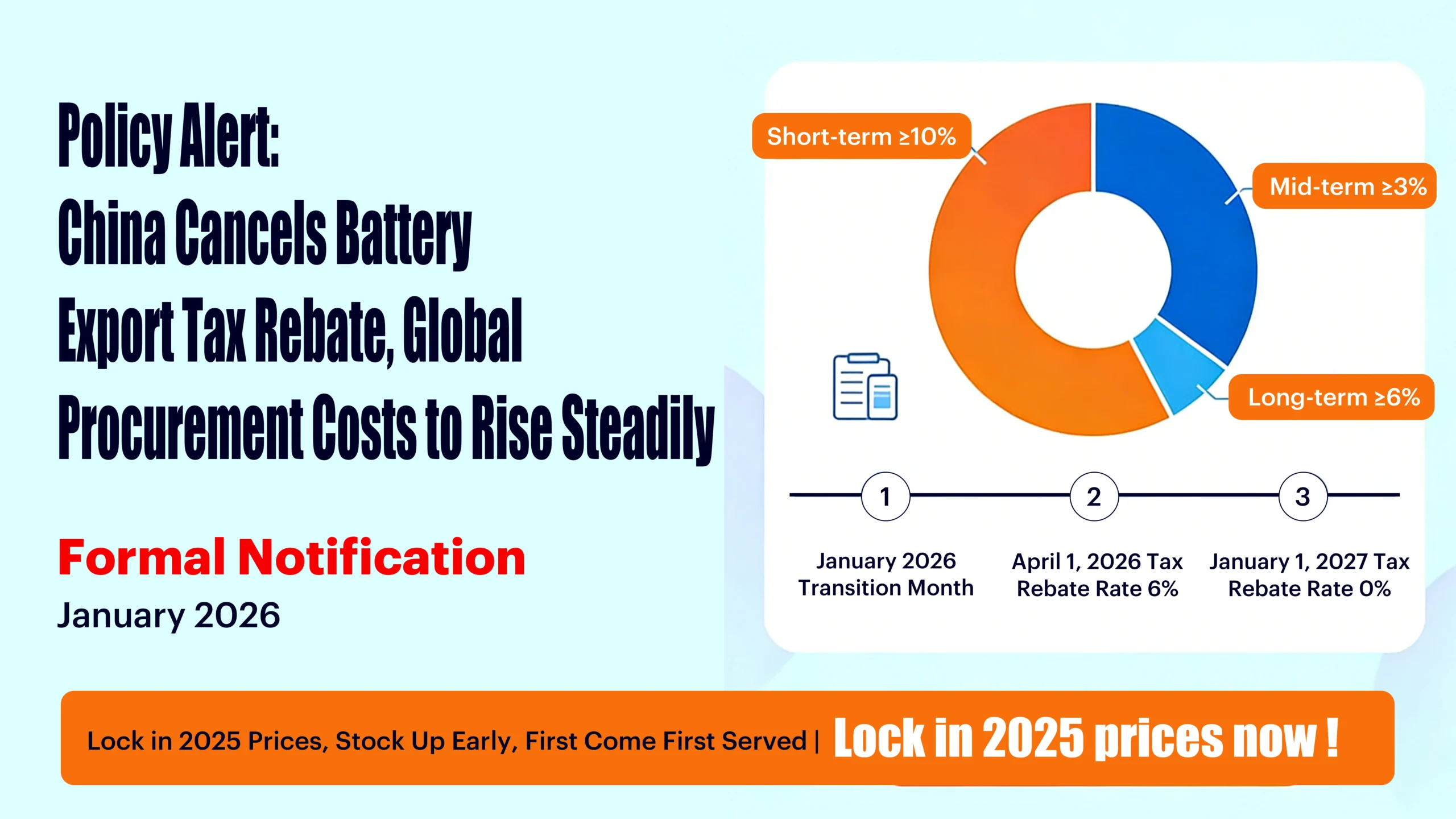

1. Policy Timeline: The Countdown on Tax Rebates

Based on the official announcement, the export tax rebate for battery products will be phased out according to the following schedule:

- January 2026: The market enters a policy transition period; due to rising raw material costs, prices for new orders are already trending upward.

- April 1, 2026: The export tax rebate rate will be reduced from 9% to 6%.

- January 1, 2027: The export tax rebate policy will be completely abolished (rebate rate drops to 0%).

2. Cost Impact Analysis: How Much Will Your Procurement Costs Increase?

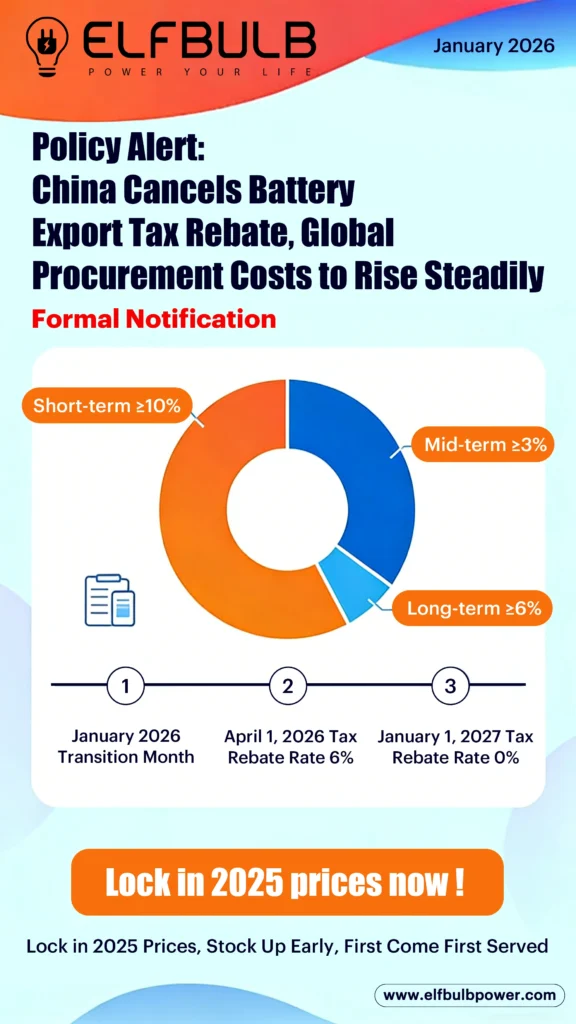

This policy adjustment will lead to a tiered increase in product quotations:

- Immediate Increase: Driven by the raw material hike in early 2026, new prices are expected to rise by ≥10% once current inventory is sold out.

- Mid-term Increase (After April 1, 2026): With the rebate rate dropping by 3%, product prices are expected to rise by at least 3%.

- Long-term Increase (After January 1, 2027): When the rebate is fully cancelled in 2027, prices are projected to rise by at least another 6%.

- Please Note: These increases represent the direct impact of the tax rebate policy and do not include potential future fluctuations in raw material costs or shipping fees.

3. ELFBULB Strategy: Lock in 2025 Price Advantages Now

To help our customers navigate this adjustment period smoothly, we recommend:

- Seize the Final Window: Take advantage of remaining opportunities to secure 2025 price levels to avoid the ≥10% raw material hike starting in early 2026.

- Plan Ahead: We strongly suggest finalizing orders before the first policy shift on April 1, 2026, to ensure your project costs remain stable.

- First Come, First Served: Promotional quotas will be allocated based on the order of contract signing—the faster you act, the greater the cost advantage.

Conclusion

The adjustment of China’s export tax rebate policy is now a reality, and rising costs are inevitable. Taking early action is not just about saving money; it is about ensuring your supply chain remains competitive during this wave of price increases.

If you have any procurement needs or require the latest policy consultation, please contact the ELFBULB sales team immediately.